Real Estate Portfolio Management

Real Estate Portfolio Management

With the increase in real estate investments, the need for managing these

investments of the investors has also increased. It becomes very difficult to manage

multiple properties when the investment becomes big.

When a NRI/HNI/Corporate makes an investment they expect steady returns in the

form of rental incomes and ultimately to sell those and earn a consolidated handsome

IRR.

This is where the role of the Seed Realty Investments arises wherein a complete

gamut of services is offered from defining and designing the objective and strategy of

real estate portfolio, executing the same, making the property rent ready, putting it on

rent, managing the cash flows and making it available to the investors.

Real estate portfolio management is a strategic approach used by investors, real estate companies, and property owners to optimize their property holdings for maximum returns and risk mitigation. It involves the careful selection, acquisition, operation, and disposition of real estate assets to achieve specific financial and operational objectives.

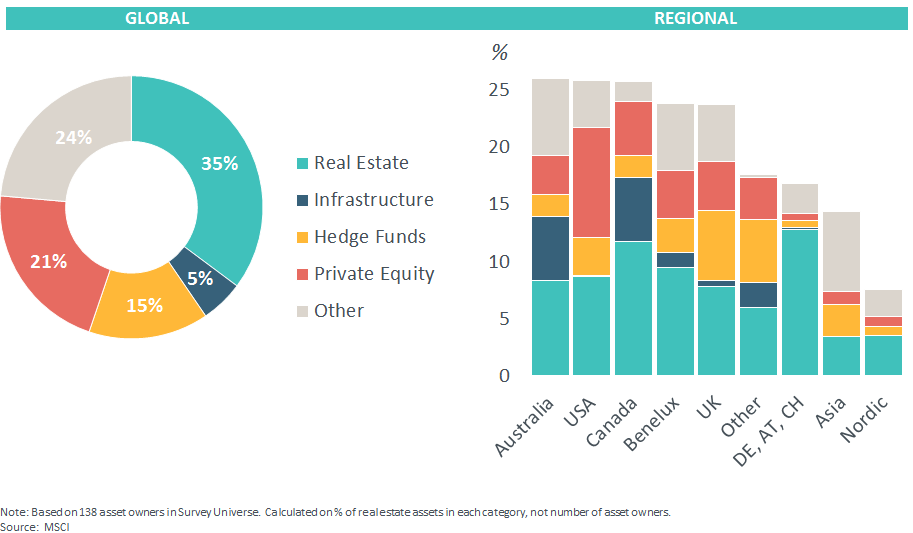

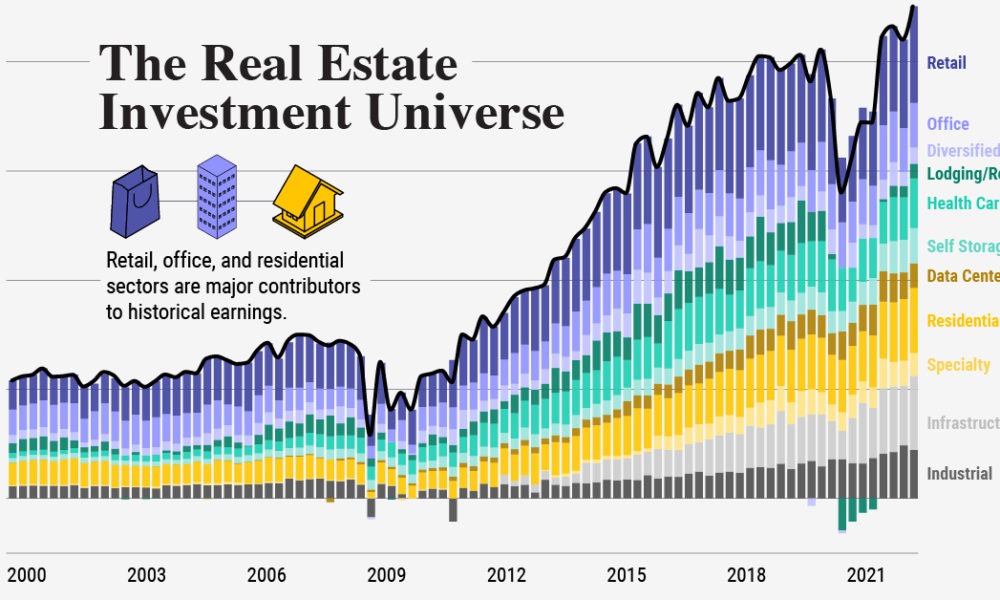

Key aspects of real estate portfolio management include diversification, asset allocation, and risk management. Diversifying a real estate portfolio across different property types (e.g., residential, commercial, industrial) and geographic locations can help spread risk and enhance overall performance. Asset allocation strategies focus on allocating capital to different properties or projects based on their expected returns and risk profiles.

- The ever growing economy across the globe is increasing the purchasing power of people and in turn it’s increasing the demand for the real estate sector.

- Real Estate, from last 7-8 years has taken the shape of an investment avenue to park funds for Non Resident Indians (NRI) and High Networth Individuals (HNI) in India

- Real Estate investment is a type of Physical Investment which may be preferred over and above the financial investments (listed stocks of real estate companies).

- With the increase of real estate investments, the need for managing these investments of the investors has also increased. It becomes very difficult to manage multiple properties when the investment becomes bigger.

- When an NRI/HNI/Corporate makes an investment they expect the steady returns in the form of rental incomes and ultimately to sell those and earn a consolidated handsome IRR.

- That is where the role of the Seed Realty arises wherein a complete gamut of services is offered from defining and designing the objective and strategy of real estate portfolio, execution of the same, making the property rent ready, putting it on rent, managing the cash flows and making it available to the investors.

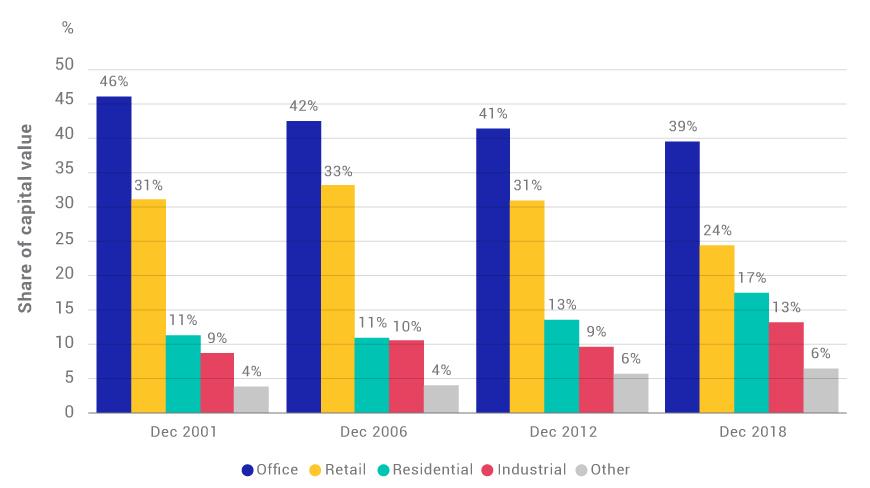

Types of Portfolio graph

Our Role

Real estate portfolio management is a strategic approach used by investors, real estate companies, and property owners to optimize their property holdings for maximum returns and risk mitigation. It involves the careful selection, acquisition, operation, and disposition of real estate assets to achieve specific financial and operational objectives.

Individual Assessment

Individual assessment is a process employed by organizations to evaluate the skills, performance, and potential of individual employees. It serves several key purposes, including performance appraisal, development planning, and talent management.

Performance appraisal involves assessing an employee’s job performance against predetermined criteria and goals. This process helps identify strengths, weaknesses, and areas needing improvement, forming the basis for feedback and compensation decisions.

Individual assessments also aid in creating tailored development plans for employees. By pinpointing specific areas for improvement, organizations can provide training and support to help individuals grow in their roles.

Portfolio Structuring

Portfolio structuring is a critical process in the world of investments and finance. It refers to the deliberate arrangement and allocation of assets within an investment portfolio to achieve specific financial objectives while managing risk. This process involves a systematic approach that takes into account various factors, including risk tolerance, investment goals, time horizon, and market conditions.

The primary goal of portfolio structuring is to create a well-balanced mix of assets that can maximize returns while minimizing risk. This often involves diversifying the portfolio by investing in different asset classes such as stocks, bonds, real estate, and cash equivalents. Diversification helps spread risk because different asset classes may perform differently under various market conditions.

Existing Assets

Existing assets in real estate refer to properties or investments that a person or organization currently owns or holds. These assets can take various forms, including residential properties, commercial buildings, land parcels, or real estate investment portfolios. Managing existing real estate assets is crucial for optimizing their value and returns.

Effective asset management involves tasks such as property maintenance, tenant relations, financial reporting, and strategic planning. Property owners and investors must regularly assess the performance of their existing assets, identify opportunities for improvement or expansion, and make informed decisions to enhance their real estate portfolio’s overall profitability.

Preleminiary Research

Preliminary research in the real estate industry is a vital initial step in any property-related venture. This phase involves gathering essential information to make informed decisions about potential investments, whether in residential, commercial, or industrial properties.

During preliminary research, individuals and organizations assess various factors. They typically examine the local real estate market, property values, trends, and historical data to gain insights into potential opportunities. Other crucial aspects include zoning regulations, tax considerations, and the availability of infrastructure and utilities.

Decision Making

Effective decision-making in the real estate industry is a critical skill for investors, developers, and property managers. It involves a careful evaluation of various factors to make informed choices that align with financial goals and risk tolerance.

One of the primary considerations in real estate decision-making is location. Assessing the desirability and growth potential of a property’s location is crucial, as it significantly impacts its value and potential for appreciation. Market research, demographic analysis, and understanding local economic trends play a pivotal role in this assessment.

Financial analysis is another key aspect. Investors need to calculate potential returns, factoring in purchase price, financing costs, maintenance expenses, and rental income or resale value. Understanding the financial feasibility of a real estate investment is essential to avoid financial pitfalls.

Managing Tenants and Brokers

Managing tenants and brokers is a crucial aspect of effective real estate management. Whether you’re a property owner or a property manager, fostering positive relationships with tenants and brokers can significantly impact the success of your real estate ventures.

For property owners, maintaining good tenant relations is essential for consistent rental income and property maintenance. Effective communication, addressing concerns promptly, and ensuring a safe and comfortable living environment are vital aspects of tenant management. Providing clear lease agreements and adhering to legal obligations also contribute to tenant satisfaction.

Managing Property Payments

Managing property payments is a critical aspect of real estate management, ensuring the financial health and stability of property investments. Property payments encompass various financial responsibilities, including rent collection, utility bills, property taxes, insurance premiums, and maintenance costs.

One key element is rent collection. Property managers or landlords need to establish efficient systems for rent collection, whether through online portals, bank transfers, or traditional methods like checks. Consistent and timely rent collection is essential for maintaining cash flow and covering property expenses.

Property tax and insurance payments are also crucial. Property owners must budget for and pay property taxes on time to avoid penalties or legal issues. Additionally, maintaining property insurance is essential to protect against unexpected damages or liabilities.

Crisp Reporting

Crisp reporting in the real estate industry is an indispensable tool for property owners, investors, and stakeholders to make informed decisions and track the performance of their real estate assets. Such reports aim to provide clear, concise, and actionable information.

These reports typically include key metrics such as occupancy rates, rental income, operating expenses, and property maintenance costs. They also encompass market analysis, highlighting trends, and forecasts in the local real estate market that can impact the property’s value or rental potential.

Society Representation

Society representation in the real estate context pertains to the relationship between property owners or managers and the homeowner or condominium associations that govern certain residential communities. These associations serve as the collective voice and governing body for the residents, overseeing common areas, enforcing community rules, and managing shared expenses.

Effective society representation involves clear communication and collaboration between property owners or managers and the association’s board or leadership. Property managers often play a crucial role in this process, acting as a liaison between property owners and the association.

Cashflow Statements

A cash flow statement in real estate is a crucial financial document that tracks the movement of money into and out of a property or real estate investment. It provides investors and property owners with a clear picture of the property’s financial health by detailing income and expenses over a specific period.

In real estate, cash flow statements typically include rental income, operating expenses (such as property management fees, maintenance costs, and property taxes), financing costs (like mortgage payments), and any other sources or uses of cash related to the property. This statement helps investors assess the property’s profitability and its ability to generate positive cash flow.

Yearly Portfolio Review

A yearly portfolio review in real estate is a critical process for investors and property managers to evaluate the performance and make informed decisions about their real estate holdings. This comprehensive assessment typically includes an analysis of property income, expenses, and overall investment strategy.

During a yearly portfolio review, investors examine key financial metrics such as cash flow, return on investment (ROI), and property appreciation. They assess the profitability of each property in their portfolio, identify any underperforming assets, and consider potential adjustments, such as property improvements or refinancing.

Advantages & Value to Clients

- Get the STRUCTURED AND CUSTOMIZED proposals only, we filter it all

- Collection of rents and making the CASH FLOW available to investors

- Taking care of the property, executing and periodically SITE VISITS

- Save time in LEGAL DOCUMENTATION of the property

- Get the GEOGRAPHICAL RESEARCH where the property is located to enable an informed decision making

- Work towards a defined INVESTMENT STRATEGY to develop a value real estate portfolio.

- Get the Portfolio Analysis and PERFORMANCE REPORT in comparison with the local real estate asset class (rental earned, increase in value, vacancy, etc)

- PROFESSIONAL FIRM to manage property rather than a relative or local brokers

- Speak to only one SINGLE PERSON for all your real estate assets rather than multiple brokers

- Get the FAIR VALUE REPORT for the property, a single page report of primary research for the rental valuation

- SAVE TIME for making site visits and showcasing the property to prospective tenants

- Broker COORDINATION AND MANAGEMENT and Owner Representation

Arrange a meeting with Seed Realty to buy your home.

Our experts and developers would love to contribute their expertise and insights and help you today.

Get in touch with us

Our experts and developers would love to contribute their expertise and insights and help you today. Our experts and developers would love to contribute.